Life Insurance That Protects.

A Career That Transforms.

Secure your family's future with life insurance or build a career that gives you financial freedom. At Bush Life Agency, we provide expert guidance for clients and a proven system for agents to thrive.

Meet Bush Life Agency: Your Partner in Success

We help you build a career that gives you more time, more flexibility, more money, and more impact.

Our mission is to empower driven individuals with the training, mentorship, and support they need to thrive in the life insurance industry. Whether you're starting fresh or transitioning from another field, we’ll help you succeed—without having to figure it all out on your own.

Are you stuck in a job that doesn’t serve you?

Trading time for money with little to show for it?

You want financial freedom and a career that rewards your hard work, but instead…

… you’re stuck in a cycle of long hours

… with capped income

… and no real control over your future

Traditional jobs often leave you burnt out, struggling to make ends meet, and missing out on time with family.

The good news? There’s a better way.

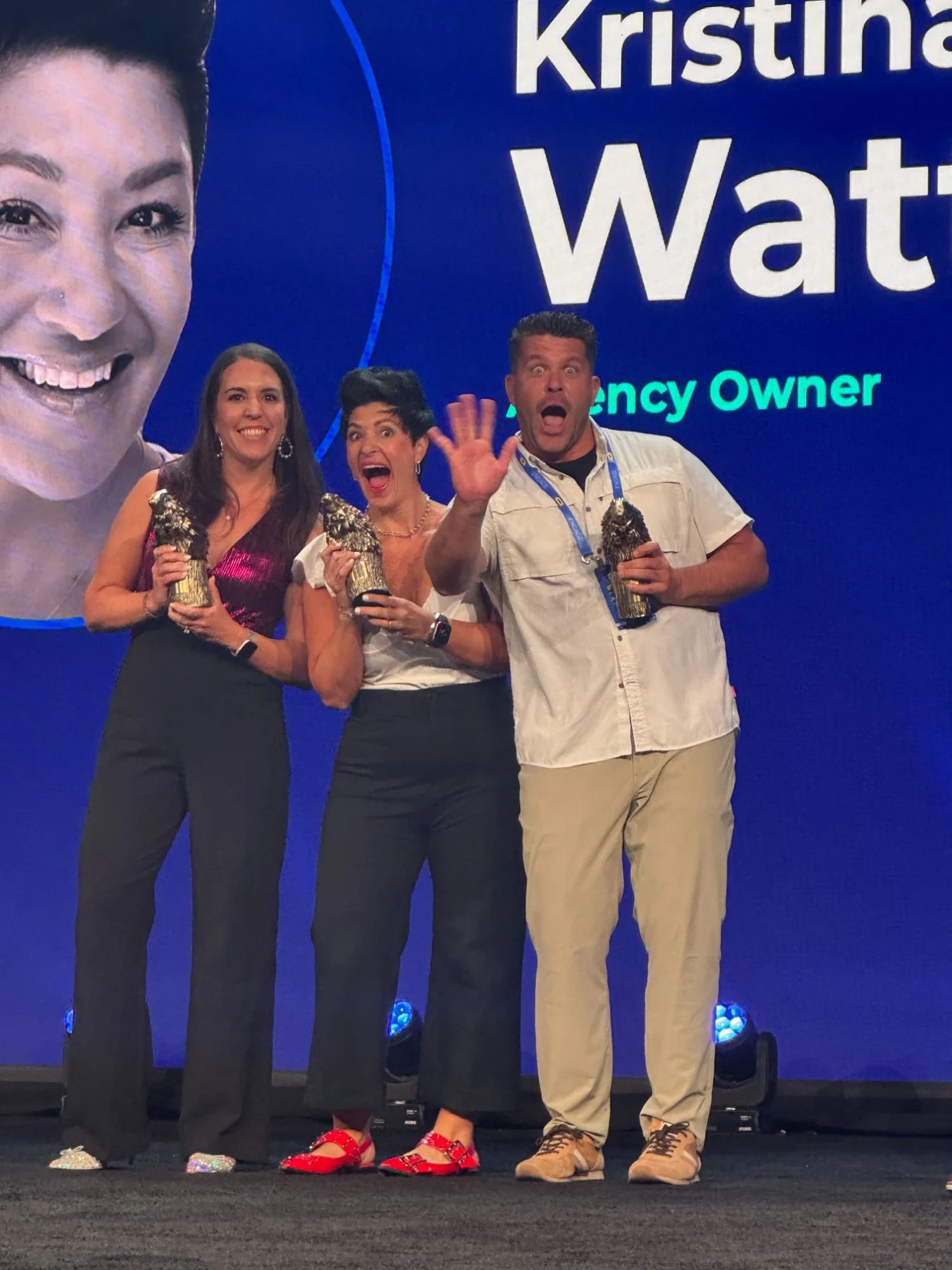

Recent Bush Life Agent Wins

Let’s Work Together

BECOME AN AGENT

We help aspiring life insurance agents build rewarding careers through a structured process, high-earning potential, and a system designed for success. Our training, mentorship, and marketing support take the guesswork out of growing your business.

GET A LIFE INSURANCE QUOTE

Life can be unpredictable, but your family’s future doesn’t have to be. At Bush Life Agency, we offer reliable life insurance solutions to protect what matters most. Whether you’re looking for term, whole, or universal life coverage, we’re here to guide you to the best option for your needs.

Life As A Bush Life Agent

┃

Life As A Bush Life Agent ┃

“Working with Bush Life Agency has been a total game-changer for me and my family!”

“As a military spouse, I needed a flexible career that could move with me when the military says it’s time to pack up - and still let me be a present parent for my kids, especially when I am solo parenting. The freedom, the support, the impact, and the ability to work from anywhere? Perfect for this crazy, ever-changing life!”

- Sara Vanderwist, Agent

Become a Life Insurance Agent

In 4 Simple Steps

-

Take the first step toward your new career by filling out a short application. We’ll review your submission and reach out to discuss your goals and next steps.

-

Our comprehensive onboarding process will equip you with the foundational knowledge and tools you need to get started confidently. We provide everything you need to hit the ground running.

-

Learn from experienced industry leaders through hands-on training, guided learning, and real-world sales techniques. You’ll gain the confidence and skills to build a successful career.

-

Your path to financial freedom and flexibility starts today. Take the first step toward a career that truly works for you.

Ready to Take Control of Your Future?

Your path to financial freedom and flexibility starts today. Take the first step toward a career that truly works for you and your family.