When it comes to safeguarding your loved ones’ future, the best life insurance policy for families is a key financial tool. But with so many options out there, it can be challenging to determine which policy to choose and what features will serve your family best. Whether you’re curious about living benefits in life insurance, considering the advantages of whole life insurance, or exploring the best life insurance policy for families, we’re here to simplify the decision-making process for you and help you choose the best life insurance policy for families.

Table of Contents

What Are Living Benefits of Life Insurance?

When most people think of life insurance, they picture financial support for their beneficiaries after they’re gone. But life insurance can provide value while you’re still living—this is where living benefits come in. Living benefits ensure that life insurance isn’t only about death—it’s about support during life’s unforeseen challenges too.

Living benefits allow policyholders to access a portion of their death benefit under specific circumstances while they’re still alive. Here’s how it might help you and your family during critical moments:

- Chronic Illness Coverage: If you’re diagnosed with a chronic illness that limits your ability to perform daily tasks, living benefits may provide financial relief for medical expenses or in-home care services.

- Critical Illness Protection: Whether you face a life-threatening illness such as a heart attack or cancer, living benefits can help cover treatments, medications, and recovery-related costs.

- Long-Term Care Coverage: Some policies allow you to use living benefits for long-term care expenses, ensuring you have the resources to age comfortably.

Policies with living benefits provide peace of mind that you’ll have financial flexibility if life throws you a curveball. Families can especially benefit from this feature by avoiding financial strain during tough times.

Understanding Whole Life Insurance

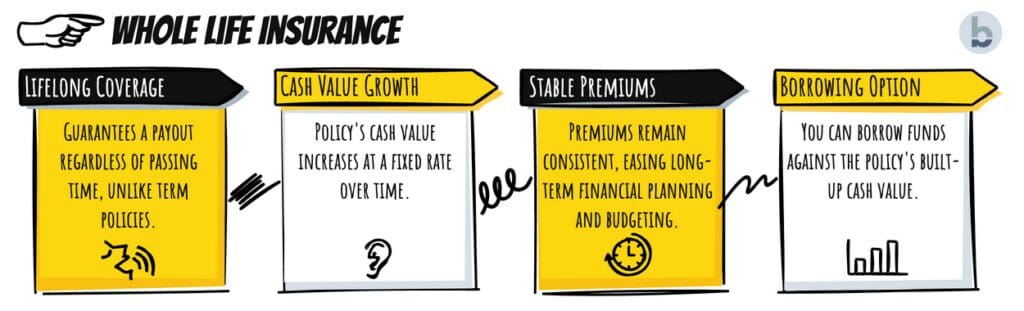

When exploring life insurance options, whole life insurance is often a popular choice for those seeking lifelong coverage. But what makes it special?

Whole life insurance provides coverage for your entire life (as long as premiums are paid) and comes with the added advantage of a cash value component. This means a portion of your premiums is invested, building savings over time.

Here’s why many individuals and families opt for whole life insurance:

- Lifelong Coverage: Whole life insurance guarantees a death benefit payout to your loved ones regardless of when you pass away, unlike term policies that only cover a limited period.

- Cash Value Growth: Over time, the cash value of your policy grows at a fixed rate. You can borrow against it, withdraw funds, or even use it as part of your retirement strategy.

- Stable Premiums: Unlike other types of insurance where premiums may increase with age, whole life insurance locks in your rate, making it easier to budget long-term.

While whole life insurance tends to have higher premiums compared to term life policies, the combination of coverage and financial growth often makes it a worthwhile investment.

Choosing the Best Life Insurance Policy for Your Family

Understanding the best life insurance policy for families requires careful consideration of each option available to ensure it meets your family’s needs.

The best life insurance policy for families often includes features tailored to protect your loved ones effectively.

Finding the best life insurance policy for families takes time but ensures your loved ones are well-protected.

What type of life insurance is best for a family? Finding the best life insurance policy for families boils down to balancing your needs and financial goals. Here are steps to guide you through the process:

1. Assess Your Coverage Needs

Ask yourself questions such as:

- How much financial support does my family need to maintain their lifestyle if I’m no longer around?

- Do I want to leave a legacy or cover specific expenses like college tuition or mortgage payments?

Your answers will help you determine the right coverage amount.

2. Decide Between Term and Whole Life Insurance

For families who need affordable, short-term protection (like during the years you’re raising children or paying off a mortgage), term life insurance can be a practical choice. But if you’re looking for lifelong coverage paired with an investment component, whole life insurance may suit your goals better.

3. Look for Family-Friendly Features

When comparing policies, consider options that provide added flexibility and value, such as:

- Riders for Children – Add-ons that cover your children under the primary policy.

- Living Benefits – For financial support while dealing with illnesses.

- Convertible Options – Some term life policies allow you to convert to whole life later on.

4. Budget for Premiums Without Overstretching

Choose a policy with premiums you can consistently afford over time. Missing payments could jeopardize your coverage—especially for whole life policies.

Consulting an expert can guide you to the best life insurance policy for families that suits your unique situation.

5. Work With a Trusted Insurance Advisor

Navigating the insurance market can be overwhelming. An experienced insurance agent, like those at Bush Life Agency, can guide you through your options while tailoring recommendations to your family’s unique needs.

We specialize in helping you find the best life insurance policy for families tailored to your needs.

Contact us to explore the best life insurance policy for families that fits your goals.

Ultimately, the best life insurance policy for families provides lasting protection and peace of mind.

Make an informed decision about the best life insurance policy for families today.

Make an Empowered Choice: best life insurance policy for families

Choosing the right life insurance policy is one of the most meaningful steps you can take to protect your family’s future. Living benefits make policies more versatile, whole life insurance provides lasting protection, and tailored family features ensure your loved ones have the support they deserve. With a little planning and guidance, you can craft an insurance strategy that offers financial security and peace of mind.

At Bush Life Agency, we’re here to help you every step of the way. Whether you’re exploring policies for the first time or need help fine-tuning your coverage, we’ll work with you to find the perfect fit.

Contact us today to discuss your family’s life insurance needs—or take the first step by browsing our life insurance resources!

Your family’s security starts with the right policy. Don’t wait—make the choice that helps you safeguard their future.