The life insurance industry is constantly changing, with many professionals desiring more autonomy and flexibility in their careers. Becoming an independent life insurance agent provides the perfect opportunity to establish your own business, customize services to meet your clients’ needs, and relish the independence of being your own boss. This blog post will offer a detailed 7-step guide to help you make a smooth transition, ensuring you have the knowledge and tools needed to succeed in How to Become an Independent Insurance Agent!

Table of Contents

Understanding the Role of an Independent Life Insurance Agent

An independent insurance agent is a licensed professional who operates independently and represents multiple insurance carriers, allowing them to offer a broader range of products to their clients compared to captive agents, who are tied to a single company. The primary responsibilities of an independent insurance agent include assessing client needs, providing expert advice, comparing coverage options, and facilitating the purchasing process. They serve as trusted advisors, ensuring that clients receive tailored insurance solutions that best fit their individual or business requirements.

Captive vs. Independent Agents

The key difference between captive and independent agents lies in their affiliations.

Captive agents can only sell products from a specific company, which may limit their ability to offer the best options for their clients.

In contrast, independent agents have the freedom to assess various companies and recommend policies that meet their client’s needs, ultimately promoting a more competitive and client-focused approach to insurance. This flexibility enables independent agents to build strong relationships with clients as they prioritize the client’s best interests over any company allegiance.

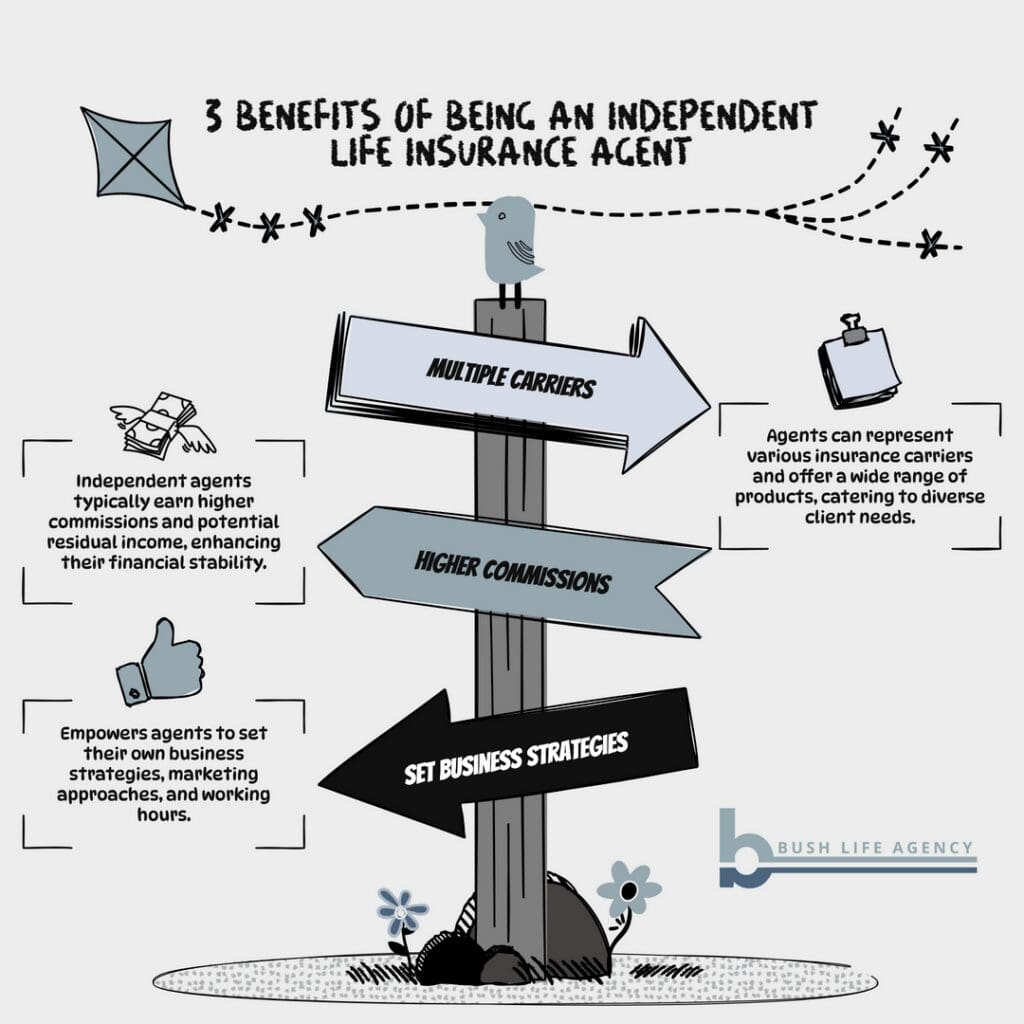

3 Benefits of Being Independent

Becoming an independent life insurance agent offers several advantages that can significantly enhance both professional satisfaction and financial success.

1 – Represent Multiple Insurance Carriers

Firstly, independence allows agents to represent multiple insurance carriers, enabling them to offer a broader selection of products tailored to the unique needs of their clients. This flexibility fosters stronger client relationships, as agents can prioritize the best options without being tied to a single company’s offerings.

2 – Higher Commission Structures

Additionally, independent agents typically enjoy higher commission structures and the potential for residual income, leading to greater financial freedom. If you’re wondering, “Does selling life insurance make a lot of money?” we have a related article you may enjoy reading here.

3 – Set Own Business Strategies

The autonomy of being independent also empowers agents to set their own business strategies, marketing approaches, and working hours, resulting in a work-life balance that aligns with their personal goals.

Overall, these benefits contribute to a more fulfilling career in the insurance industry.

1 – Assessing Your Current Situation

Whether you’re new to the world of life insurance or thinking of transitioning into an independent role there are things to evaluate to see if this is a good move for you.

Transitioning to an independent insurance agent requires a thorough evaluation of your current position and skill set. Begin by taking stock of your existing experience in the insurance industry, including any specific areas of expertise, such as life, health, property, or casualty insurance. This self-assessment will help you identify your strengths and how they can be leveraged in your new role.

Next, it’s crucial to pinpoint any gaps in your knowledge or experience that may hinder your transition. Consider areas such as understanding various insurance products, mastering sales techniques, or navigating the regulatory landscape for independent agents. Seeking additional training or mentorship in these areas can be immensely beneficial.

Finally, set clear and achievable goals for your transition. Whether it’s obtaining necessary licenses, developing a client acquisition strategy, or building a professional network, having specific objectives will provide direction and motivation throughout your journey. Establish a timeline for achieving these goals to help keep you accountable as you make this significant career change.

At Bush Life Agency, we developed this career assessment quiz to see if you’re a good fit as an independent life insurance agent – START HERE!

2 – Building a Strong Business Plan

A well-structured business plan is crucial for the success of your independent insurance agency. It serves as a roadmap that guides your operations, sets clear objectives, and helps you navigate the complex landscape of the insurance industry. A solid business plan enables you to identify opportunities, manage risks, and secure funding if needed.

Importance of a Business Plan

Creating a business plan not only provides clarity on your vision and goals, but it also helps in attracting potential clients and agents. It demonstrates your professionalism and commitment to running a successful agency, which can instill confidence in your team.

3 Key Components

- Market Analysis: This section involves researching the current insurance market, understanding competitor strengths and weaknesses, and identifying trends that influence consumer behavior. A thorough market analysis will inform your strategies and highlight areas where you can differentiate your offerings.

- Target Audience: Defining your target audience is vital for tailoring your services to meet their specific needs. Consider demographic factors, such as age, income, and location, and psychographic factors, such as lifestyle choices and values. Understanding your audience will enable you to craft effective marketing messages and develop strong client relationships.

- Financial Projections: Projecting your financial performance helps you establish realistic revenue and expense expectations. Outline your anticipated start-up costs, operating expenses, and expected income streams. This financial planning is essential for managing your cash flow and ensuring the long-term viability of your agency.

Strategies for Growth and Sustainability

Incorporate strategies for growth and sustainability within your business plan. Consider methods such as networking within industry associations, leveraging digital marketing to reach potential clients, and building partnerships with other professionals.

Additionally, developing a robust referral program can enhance client retention and attract new business. Regularly revisiting and updating your business plan will help you stay aligned with your objectives and adapt to any changes within the insurance market.

3 – Licensing and Legal Requirements

Navigating the licensing and legal landscape is essential for establishing your independent insurance agency to sell life insurance. Compliance with state-specific regulations not only protects your business but also enhances your credibility in the eyes of clients and partners.

Overview of Necessary Licenses and Certifications

To function as an independent insurance agent, securing the necessary licenses, including the life insurance licensing, is crucial. This usually requires obtaining a property and casualty license, as well as any other certifications relevant to the products you plan to sell, such as health and life insurance licenses. Since requirements vary by state, consulting your state’s insurance department for specific guidelines and application processes related to the life insurance licensing and other certifications is essential.

Understanding State-Specific Regulations

Each state has its own set of regulations governing insurance practices, including continuing education requirements, which ensure agents remain knowledgeable about industry changes and legal updates. Stay informed by actively engaging with state insurance boards, attending relevant workshops, and participating in professional associations.

You can find your Agent/Producer/Agency Licensing Information on your state’s insurance website. For example here is the site for Missouri.

Tips for Staying Compliant

- Maintain Accurate Records: Keep thorough documentation of all transactions, communications, and client interactions. This not only aids compliance but also helps build trust with your clients.

- Stay Updated: Regularly review changes in insurance laws and regulations to ensure your practice aligns with current requirements. Subscribing to industry newsletters and joining professional groups can provide valuable insights.

- Implement Training Programs: Establish ongoing training for yourself and your staff to reinforce compliance and ethical sales practices.

- Consult Legal Experts: When in doubt, consulting with legal professionals who specialize in insurance law can provide guidance and ensure you are on the right track.

By adhering to licensing and regulatory requirements, you position your agency for success while safeguarding your clients’ interests and maintaining a solid reputation in the industry.

4 – Establishing Your Brand and Marketing Strategy

Creating a Unique Brand Identity

Establishing a distinct brand identity is critical for standing out in the competitive insurance market. Your brand should reflect your agency’s values, mission, and the services you provide. This includes selecting a professional logo, color scheme, and messaging that resonates with your target audience.

Consistency in branding across all platforms—like your website, marketing materials, and social media profiles—builds recognition and trust among potential clients.

Developing a Marketing Plan

A comprehensive marketing plan is essential for promoting your agency effectively. Focus on creating an online presence through a user-friendly website that showcases your services, client testimonials, and educational content that positions you as an industry expert. Networking is equally important; attend community events and industry conferences to make connections and build relationships. Additionally, implement a referral program that incentivizes existing clients to recommend your services to friends and family, further expanding your client base.

Utilizing Social Media and Digital Marketing Tools

Leveraging social media and digital marketing tools can significantly enhance your outreach. Platforms like Facebook, LinkedIn, and Instagram provide excellent opportunities to engage with your audience and showcase your expertise.

Create informative and engaging content, such as blog posts, infographics, and videos, that highlight key insurance topics and solutions.

Additionally, consider using paid advertising and email marketing campaigns to reach a broader audience, driving traffic to your website and generating leads.

Regularly analyzing your marketing efforts will help refine your strategy, ensuring sustained growth and visibility for your agency.

5 – Building a Network and Client Base

Networking is the lifeblood of the insurance industry for life insurance sales.

- Building relationships with industry peers, referral sources, and potential clients can lead to valuable insights, support, and business opportunities.

- Active participation in professional associations, conferences, and local events not only helps you stay informed about market trends but also enhances your visibility and credibility within the community.

- Join industry associations such as the National Association of Professional Insurance Agents (PIA) for support and networking opportunities.

- Establishing a strong network positions you as a trusted professional, increasing the likelihood that others will refer clients to your agency.

9 Effective Methods for a Life Insurance Agent to Generate Leads

- Networking and Relationship Building

- Attend industry events, local community gatherings, and business expos to meet potential clients and expand your professional circle.

- Join business networking groups and professional associations to connect with other professionals who can refer clients to you.

- Develop strong relationships with existing clients who can provide referrals and introduce you to new prospects.

- Utilizing Social Media Platforms

- Leverage platforms like LinkedIn, Facebook, and Instagram to share valuable content and engage with a broader audience.

- Create informative posts and videos that address common questions and concerns about life insurance.

- Participate in relevant groups and forums to offer insights and establish yourself as an expert in the field.

- Creating Valuable Content

- Develop blog posts, e-books, and videos that provide educational information about life insurance benefits and options.

- Use this content to drive traffic to your website and capture leads through contact forms or newsletter subscriptions.

- Offer free resources or consultations to entice potential clients and gather their contact information.

- Hosting Educational Seminars

- Organize webinars or in-person seminars on life insurance topics to educate the public and showcase your expertise.

- Partner with local community centers or businesses to reach a wider audience.

- Collect attendee information during these events to follow up with personalized offers or consultations.

- Partnerships with Financial Advisors and Real Estate Agents

- Collaborate with financial advisors and real estate agents who can refer their clients to you for life insurance needs.

- Establish mutually beneficial relationships where you refer clients to each other, enhancing both your services.

- Provide value to their clients by offering customized insurance solutions that complement their financial goals or real estate investments.

- Leveraging Online Advertising and SEO

- Invest in online advertising through Google Ads or social media platforms to target specific demographics and attract potential leads.

- Optimize your website for search engines to improve visibility and drive organic traffic from individuals searching for life insurance.

- Use targeted keywords and local SEO strategies to reach potential clients in your area.

- Referral Programs and Customer Testimonials

- Implement a referral program that rewards existing clients for referring new leads to you.

- Use customer testimonials and success stories in your marketing materials to build trust and credibility with prospects.

- Encourage satisfied clients to share their positive experiences on review sites and social media.

- Maintaining a Strong Online Presence

- Ensure your website is professional, user-friendly, and informative to attract and convert visitors into leads.

- Maintain active profiles on social media platforms and engage with your audience regularly.

- Utilize CRM tools to manage and nurture leads efficiently, keeping track of interactions and follow-ups.

- Purchasing Leads from Lead Generation Companies

- Agents can buy leads directly from companies specializing in lead generation. These companies collect consumer information through various channels like online forms, surveys, and advertisements.

- It’s essential to research and choose reputable companies known for providing high-quality leads that align with your target market.

By adopting these methods, life insurance agents can effectively generate leads, ensuring a steady stream of potential clients and opportunities for business growth.

6 – Setting Up Financial Systems and Processes

Establishing robust financial systems and processes is vital for the long-term success of your insurance agency. Start by creating a clear accounting structure to track income, expenses, and cash flow. This ensures that you have accurate and up-to-date financial information at your fingertips, which is crucial for making informed business decisions.

Additionally, consider implementing internal controls to prevent fraud and ensure compliance with applicable regulations. Regular financial assessments will help identify trends and prepare for any potential challenges.

7 – Continuous Learning and Adaptation

The insurance industry is dynamic, with constant changes in regulations, products, and technology. Commit to continuous learning and professional development. Stay informed about industry trends and new technologies that can enhance your service offerings. Adaptability is crucial to maintaining a competitive edge.

Subscribing to industry publications, attending conferences, and participating in webinars are effective ways to stay informed and position your agency as a leader in the field.

At Bush Life Agency our agents are invited to attend our annual convention hosted by our parent company Symmetry.

Conclusion: How to Become an Independent Life Insurance Agent

In conclusion, embarking on the journey to becoming an independent life insurance agent can be both rewarding and challenging. By following the steps outlined in this article, you can confidently transition into this new role with the necessary knowledge and tools. Embrace the opportunity to shape your career, deliver personalized services to clients, and enjoy the freedom of being your own boss. The life insurance industry is evolving, and with determination and strategic planning, you can position yourself for success in this dynamic field.

We invite you to join the conversation with us. Ask questions and explore whether a career transition to becoming a life insurance agent is right for you. Fill out this form to set up a call with us – START HERE.

For other questions you may have – read these related articles:

How stressful is selling life insurance? Read here.

Does selling life insurance make a lot of money? Read here.

Is selling life insurance a good career opportunity? Read here.