This article explores the steps and strategies for starting a career as an insurance agent from the comfort of your home, especially for parents looking to balance work and family life. It covers essential topics such as obtaining the necessary licenses, understanding industry requirements, setting up a home office, and leveraging technology to connect with clients. Additionally, it offers tips on time management and how to create a successful work-life balance while working remotely in the insurance field. Whether you’re new to the industry or looking for a flexible career option, this guide on How to Become an Insurance Agent from Home will help you get started.

Table of Contents

Why Becoming an Insurance Agent from Home is an Ideal Career for Parents

Becoming an insurance agent from home is an excellent career choice for parents who need flexibility while managing their families. This career allows you to set your own schedule, making it easier to attend parent-teacher meetings, children’s activities, or even provide childcare during the day. Remote work eliminates the need for a daily commute, saving valuable time and energy that can be redirected to caring for your family.

Additionally, the insurance industry offers substantial earning potential with commissions and residual income, which can help contribute to your household’s financial stability. By working from home, parents can create a balanced lifestyle where they can be present for their children while also building a rewarding and sustainable career.

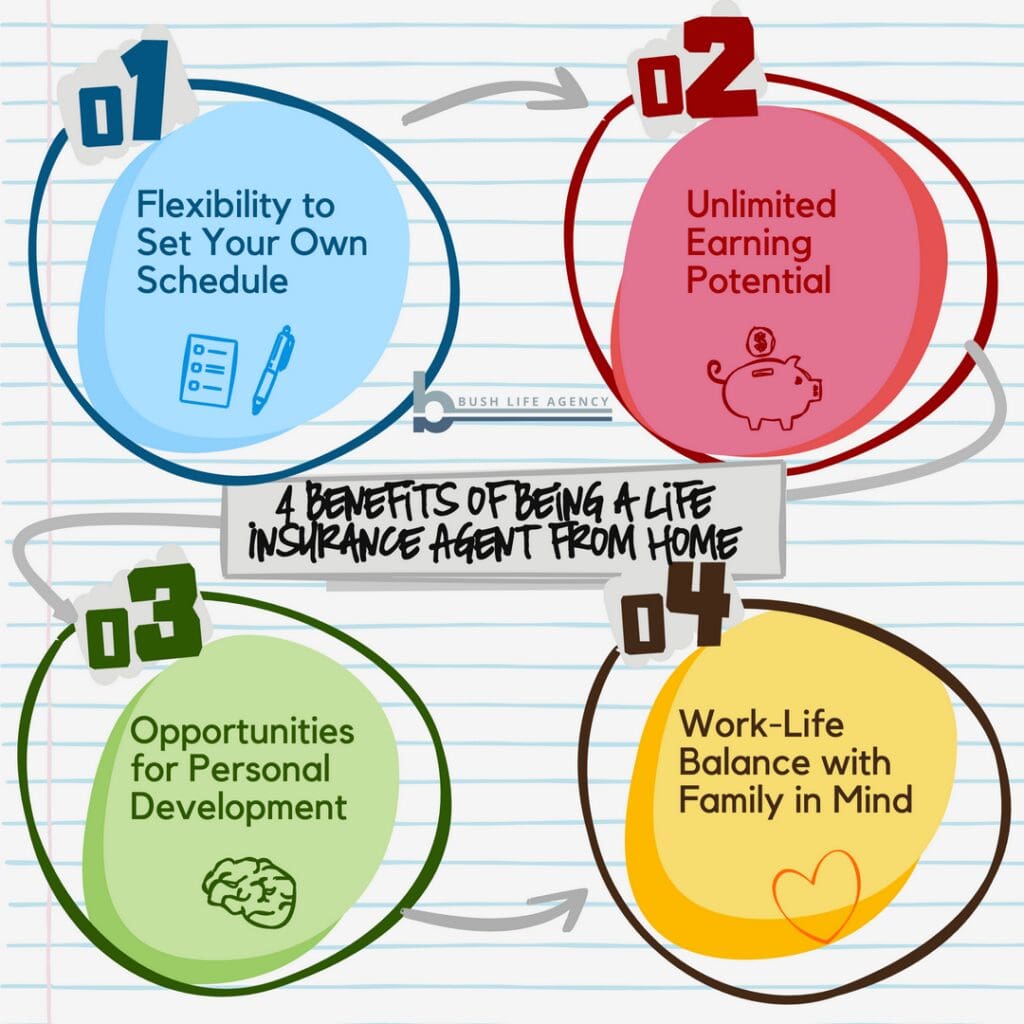

4 Benefits of Being a Life Insurance Agent From Home

1 – Flexibility to Set Your Own Schedule

Working from home as an insurance agent allows you to tailor your schedule around your children’s needs and daily activities. Whether it’s dropping them off at school, attending their sports practices, or helping with homework, you have the freedom to plan your work hours in a way that complements your role as a parent.

This level of flexibility means you can be present for the moments that matter most while still growing your career. The ability to work around your family’s routine creates a harmonious balance, ensuring that both your personal and professional life thrive.

2 – Unlimited Earning Potential

One of the most appealing aspects of working as an insurance agent from home is the commission-based income model. Rather than being tied to a fixed salary, your earnings are directly linked to the policies you sell, giving you the opportunity to scale your income based on your performance.

Even if you work part-time or during irregular hours, the insurance industry rewards dedication and results, allowing you to build a substantial income over time. Many insurance companies also offer residual income, meaning you can continue earning from policies sold in previous years as long as clients maintain their coverage. This creates a pathway for sustained financial growth, making it an ideal career not only for full-time professionals but also for those managing family responsibilities while working part-time.

3 – Opportunities for Personal Development

Working as an insurance agent from home fosters significant personal growth by enhancing key skills such as communication, sales strategies, and self-confidence. Interacting with clients regularly helps you refine your ability to listen actively, communicate clearly, and respond to various questions or concerns with empathy and professionalism. These improved communication skills are not only valuable in your career but also in personal relationships and day-to-day interactions.

4 – Work-Life Balance with Family in Mind

A career as an insurance agent from home offers the opportunity to spend more quality time with your children compared to traditional 9-to-5 jobs. The flexibility of setting your own hours means you can structure your workday around your family’s schedule, ensuring you’re available for school drop-offs, family meals, or simply being present for your kids when they need you most.

Unlike rigid office jobs, this career allows you to be more involved in your children’s daily lives while still pursuing your professional goals. By working from the comfort of your home, you also eliminate the stress and time commitment of commuting, freeing up even more time to focus on what truly matters — your family. The ability to actively participate in your children’s upbringing, while achieving financial and career success, makes this path uniquely rewarding for parents seeking meaningful balance.

Overcoming 3 Common Challenges as an Independent Life Insurance Agent at Home

Our young family soon after I started as a life insurance agent.

Steps to Get Started as an Insurance Agent

Understand the Role of an Insurance Agent

An insurance agent plays a crucial role in helping individuals and families secure their financial futures by providing guidance and solutions tailored to their needs. The primary responsibility of an insurance agent is to sell insurance policies, which may range from life and health insurance to home, auto, and business coverage. Agents must thoroughly understand the products they offer and be able to explain complex policy details in a clear and engaging manner.

Beyond sales, an insurance agent is also responsible for building and maintaining long-term relationships with clients. This involves providing ongoing support, addressing concerns, and ensuring that clients’ insurance needs are continuously met as their circumstances change over time. Effective client management is essential for creating trust and retaining a loyal customer base.

Another key aspect of the role is assisting clients with insurance claims. When a client files a claim, an insurance agent acts as a guide, helping them through the process to ensure it is handled efficiently and accurately. This includes answering questions, liaising with the insurance company, and advocating for the client when necessary. By fulfilling these responsibilities, insurance agents serve as trusted advisors, playing a pivotal role in giving their clients peace of mind and financial security.

Since Bush Life Agency is a life insurance agency, I’ll share specifically about getting started as a life insurance agent!

Choose a Niche or Specialty

Selecting a niche or specialty as an insurance agent can significantly enhance your career by setting you apart from competitors and allowing you to focus on areas where you can provide exceptional value to your clients. While insurance is a broad field, specializing in a specific type of insurance helps you develop in-depth expertise, making you a trusted authority in that area. Examples of common insurance specializations include life insurance, health insurance, auto insurance, home insurance, and business insurance.

Specializing in life insurance allows you to help clients protect their loved ones and plan for future financial security. This niche often involves working closely with families and individuals seeking peace of mind, knowing their dependents will be cared for in their absence.

Health insurance, on the other hand, focuses on assisting clients in navigating complex healthcare systems and choosing policies that cover their medical needs effectively. This is a highly impactful niche, as healthcare expenses are a major concern for many individuals and families.

If you choose to specialize in auto insurance, you’ll focus on providing coverage for vehicles, helping clients safeguard their investments and comply with legal requirements.

Similarly, homeowners’ insurance enables you to protect clients’ most valuable assets—their homes—by offering policies that cover property damage, theft, and liability.

Lastly, specializing in business insurance allows you to support entrepreneurs and companies by offering tailored policies that protect against financial losses due to property damage, liability claims, or other risks unique to businesses.

By narrowing your focus to a specific niche, you’re able to build a deeper understanding of the products and the unique needs of your target audience. This enables you to offer tailored advice and solutions that stand out in a competitive market. Clients are more likely to trust and do business with an agent who demonstrates expertise and specialized knowledge in a particular area, making this approach a powerful strategy for career growth and client retention.

Since Bush Life Agency is a life insurance agency, I’ll share specifically about getting started as a life insurance agent!

Educational Requirements and Licensing For Life Insurance Agents

To become a licensed life insurance agent, meeting specific educational and licensing requirements is essential. The process typically includes completing pre-licensing education courses, passing a state licensing exam, and obtaining your insurance license. Pre-licensing courses are often available online, allowing you to study at your own pace and balance your education with family responsibilities. These courses cover critical topics such as insurance laws, ethical practices, and the details of various policy types, equipping you with the foundational knowledge needed to excel in the field.

Once you’ve completed your pre-licensing education, you’ll need to pass the state licensing exam. The exam tests your understanding of the material covered in the courses and ensures that you’re prepared to advise clients on their insurance needs. Each state has its own requirements regarding the licensing process, so it’s important to research and follow the guidelines relevant to your location. Staying organized and setting realistic study goals can help you prepare effectively for the exam.

For parents managing kids while preparing for the licensing exam, time management and efficient study techniques are key. Create a study schedule that aligns with your responsibilities, such as studying during nap times, school hours, or after your kids are in bed. Breaking your study sessions into smaller, focused units can help you retain information more effectively without feeling overwhelmed. Additionally, leveraging study aids like practice exams, flashcards, and video tutorials can make the process more engaging and less time-consuming.

Finally, consider involving your family in your goals. Sharing your career aspirations with your children not only helps them understand the value of hard work but can also foster their support during your study period. By approaching the educational and licensing process with a structured plan and a positive mindset, you can efficiently transition into your new career while managing your role as a caregiver.

How to Successfully Transition to an Independent Life Insurance Agent

Research Companies or Agencies to Work With

Before starting your career as a life insurance agent, one of the most crucial steps is to research companies or agencies that align with your professional goals and offer the support you need to succeed. Look for organizations with strong reputations, comprehensive training programs, and a proven track record of helping agents thrive. Consider factors such as commission structures, available resources, and opportunities for career advancement when evaluating potential employers.

To identify companies, start by exploring well-established insurance providers and agencies in your area or online. Reading reviews and testimonials from current and former agents can offer insight into the company culture and whether they support remote work or flexible schedules. A remote-friendly employer is ideal if you’re juggling family responsibilities, as it can provide the flexibility to manage your time effectively.

Another option to consider is becoming an independent insurance agent. This path allows you to work for yourself, giving you the freedom to set your own schedule and choose the insurance carriers you represent. To succeed as an independent agent, you’ll need to build strong connections with multiple insurance companies to offer a wide range of products to your clients. Networking, attending industry events, and participating in online forums can help you establish these essential partnerships.

If you’re looking for remote-friendly roles, focus your search on companies with modern digital platforms and a commitment to supporting virtual work environments. Employers that provide tools like electronic policy forms, CRM software, and online communication tools can simplify your workflow and enhance efficiency. Websites such as LinkedIn, Indeed, and specialized insurance job boards are excellent resources for finding remote insurance agent positions.

By thoroughly researching and carefully choosing the right company or agency to work with, or deciding to become independent, you can set yourself up for a successful and rewarding career in the insurance industry.

Invest in the Right Tools and Technology

Equipping yourself with the right tools and technology is essential to thriving as an insurance agent, especially in today’s digitally driven market. A reliable laptop or computer is the foundation of your work setup, as it allows you to access online platforms, manage client information, and communicate effectively. Invest in a device with sufficient processing power, a long-lasting battery, and robust security features to protect sensitive client data.

Equally important is a reliable internet connection, particularly if you plan to work remotely. High-speed internet ensures smooth communication through video calls, seamless access to online tools, and efficient file sharing. Consider upgrading to a plan that offers enhanced upload and download speeds if your current connection is slow or inconsistent.

One of the most critical tools for insurance agents is customer relationship management (CRM) software. A CRM allows you to organize client information, track interactions, and manage follow-ups, ultimately improving your ability to maintain strong relationships with your clients. Many CRM solutions are designed specifically for insurance professionals, offering features like policy tracking, automated reminders, and sales analytics to streamline your workflow and boost productivity.

Additionally, tools such as e-signature software can facilitate the digital signing of contracts and forms, saving time for both you and your clients. Platforms like cloud storage services ensure that your important documents are securely stored and easily accessible from anywhere. Investing in these technologies not only enhances your professionalism but also enables you to work efficiently and offer a seamless experience for your clients.

By prioritizing the right tools and technology, you set yourself up for success, allowing you to focus on delivering excellent service and growing your business.

We invite you to join the conversation with us. Ask questions and explore whether a career transition to becoming a life insurance agent is right for you. Fill out this form to set up a call with us – START HERE.