Mastering the art of “how to sell insurance” is both a challenge and an opportunity for many agents. Turning leads into loyal clients is the goal of the life insurance industry. For agents, it means building a stable business with referrals and repeat business. For clients, it’s about finding a reliable partner in the insurance maze, someone who offers personalized advice and makes the process feel comfortable.

With countless products and changing regulations, the insurance industry can seem daunting. Yet, within this complexity lies a wealth of opportunities for those willing to unlock its secrets. Whether you’re a seasoned agent or just starting your career, understanding the nuances of selling insurance is crucial to standing out and building a loyal client base.

In this article, we’ll delve into proven strategies, share real-world examples, and offer expert tips to help you navigate the journey from prospecting to closing deals with confidence and finesse. Ready to transform your approach and drive success in your insurance sales career? Let’s dive in!

Table of Contents

Understanding the Life Insurance Client Journey

Navigating the path from lead to loyal client involves understanding the typical client journey. It all starts at the first point of contact, where potential clients evaluate their needs against what you offer.

Key stages include building initial trust, understanding specific needs, presenting tailored solutions, and finally, securing their commitment. Each interaction is a stepping stone in shaping their decision to stay with you for the long haul.

5 Key Stages of the Life Insurance Client Journey

Ah, the life insurance client journey—it’s like a dramatic series with some cliffhangers that can decide if you’re getting a happily-ever-after or a nerve-wracking suspense. Let’s dive into those pivotal moments:

- The First Impression Fiasco or Fiesta: First impressions are crucial. This is your initial contact with the lead, whether through a cold call, an email, or a meeting at an event. It’s your opportunity to stand out.

- The “Why Do I Need This?” Enlightenment: Here’s where you channel your inner life coach. During this stage, your interaction should pivot on educating the client about the real benefits of life insurance, making sure they move from skeptical spectator to engaged listener.

- The Objections Showdown: Objections are like that final level in a video game—annoying but necessary to conquer. Each objection is a stepping stone to purchase decisions, and your job is to handle them like a pro magician pulling rabbits out of hats, leaving the client thinking, “Well, why not?”

- The Trust Test: This is where your human side plays a stare-down with the sales side. Building trust is key, and your interactions here need to be all about proving reliability and creating a comfort zone where doubts perish and faith flourishes.

- The “Let’s Make This Official” Convo: The moment of truth—where you graduate from ‘the salesperson I spoke to’ to ‘my insurer.’ It’s all about sealing the deal while ensuring the client feels more like they’re walking down the aisle than walking the plank.

Each of these critical junctures requires a sprinkling of charm, a drizzle of expertise, and a dash of humor—because let’s face it, life’s too short for insurance conversations that are dry as toast.

Effective Sales Techniques for Selling Life Insurance Policy

Relationship Building

The foundation of any successful sales journey is rapport. Building trust from the get-go ensures clients feel comfortable and valued. Show genuine interest in their lives, ask open-ended questions, and listen actively. These connections transform transactions into meaningful relationships.

Building and maintaining meaningful relationships with your clients requires attention and a personalized approach. Here are some tips to keep your clients engaged:

- Listen Attentively: When engaging with clients, truly listen to their needs and concerns. Show you’re paying attention by repeating back what they’ve shared and confirming their message.

- Personalized Check-Ins: Make your follow-ups thoughtful by mentioning personal details they’ve shared. This shows you see them as a person, not just a potential commission.

- Informative Updates: Keep your clients informed about industry changes that might impact them. Make sure to explain it in a relatable way.

- Celebrate Milestones: Acknowledge anniversaries and personal milestones to show you’re invested in their life journey.

- Be a Trusted Advisor: Continuously update your own knowledge so you’re equipped to offer the guidance they need for their insurance queries.

Needs-Based Selling

Tailoring solutions to meet individual needs is crucial. Instead of pushing policies, focus on aligning your offerings with the client’s personal goals and concerns. This approach not only enhances their confidence in you but also demonstrates your commitment to their well-being.

Understanding and aligning life insurance products with your client’s specific goals and concerns can feel like piecing together a complex jigsaw puzzle—totally satisfying when you get it right! Here’s how to ensure their needs and your solutions are a perfect match:

- Conduct a Thorough Needs Analysis: Start with a comprehensive conversation to uncover your client’s financial goals, family dynamics, and long-term aspirations. Remember, each client is as unique as their thumbprint, so avoid cookie-cutter solutions.

- Identify Key Concerns: Actively listen to any worries or reservations they might have—whether it’s about premium costs, coverage limits, or anything in between. Addressing these concerns upfront can turn skeptics into believers.

- Customize the Solution: Once you have a clear picture, design a proposal that addresses their goals and eases concerns. Highlight how specific features of the policy benefit their personal scenario, making it clear you’re not just selling a product, but offering peace of mind.

- Present Options Clearly: Avoid jargon-laden speeches that make their eyes glaze over. Instead, offer a simple breakdown of options, ensuring they grasp the whats, whys, and hows before signing on the dotted line.

- Engage in Open Dialogue: Encourage them to ask questions and express their doubts. This helps them feel valued and shows you’re not just here for a sale, but to ensure their financial plans align seamlessly with their life goals.

- Follow Up with Reassurance: After your initial proposal, give them some time to digest the information, then check in with reassurances and further explanations. This reinforces your commitment to aligning your services with their needs continuously.

By tailoring your approach to each client’s unique situation, you’ll not only help them find the perfect life insurance solution but also cultivate a lasting, fulfilling relationship that can withstand the test of time (and even those dreaded policy renewals).

Real-World Examples and Expert Advice

Consider the story of Sarena, a hesitant lead who turned into a committed client. Initially skeptical about the long term benefits of life insurance, Jamie was won over by personalized attention and clear explanations. The secret? Emotional intelligence. By understanding and responding empathetically to client emotions and concerns, agents can create stronger connections and ease apprehensions.

Building Long-Term Relationships

- Regular Touchpoints: Consistent follow-ups and check-ins are vital. Use communication tools like email newsletters or personalized messages to keep the conversation going. This ensures clients feel valued and keeps you top-of-mind.

- Personalization: Small gestures can lead to big loyalty. Remembering birthdays, sending holiday greetings, or tailoring communication to their interests shows clients they’re more than just a policy number.

Handling Common Client Objections

Financial Concerns: Clients often hesitate due to cost. Address these concerns by highlighting the value and long-term benefits of the policies, and offer flexible payment options where possible.

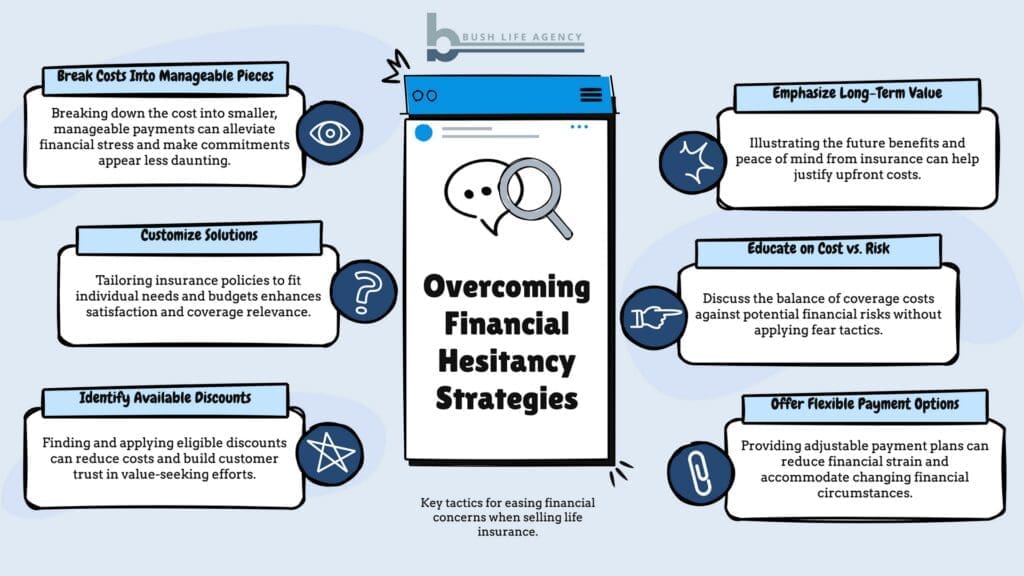

6 Solutions for Addressing Financial Hesitations

- Tactic 1: Break It Down to Bite-Sized Pieces: When clients hear the total cost, they might imagine their wallet vanishing into a black hole. Help them by breaking down the costs into manageable monthly or quarterly payments. This can make the financial commitment seem less daunting—kind of like choosing appetizer platters over a full buffet!

- Tactic 2: Highlight the Long-Term Value: Paint a picture of the future—they’ll thank you later! Demonstrate how the benefits of life insurance, such as financial security and peace of mind, far outweigh the immediate costs. Offer relatable scenarios where life insurance was the ultimate protector in unexpected times.

- Tactic 3: Offer Tailored Solutions: Nobody likes a one-size-fits-all approach. Tailor the policy to fit their budget while ensuring the coverage meets their needs. Talk about customizable features that allow flexibility both cost-wise and coverage-wise.

- Tactic 4: Educate on Cost vs. Risk: Engage in a candid conversation about risks related to not having adequate coverage. The key here is sensitivity—you’re not here to scare them into buying insurance, but to help them weigh the true cost of potential risks against the price of coverage.

- Tactic 5: Explore Available Discounts and Offers: Uncover any available discounts they might be eligible for—whether it’s bundling policies or tapping into group discounts. This not only saves money but also boosts trust, showing you’re invested in giving them the best value.

- Tactic 6: Flexibility with Payment Plans: Discuss flexible payment options that allow for adjustments if their financial situation changes, turning potential financial strain into financial ease. Not everyone has a consistent income, and providing leeway helps in maintaining the policy long-term.

Policy Complexity: Insurance jargon can be daunting. Simplify complex details with clear, concise explanations and analogies that resonate with their everyday experiences.

Professional Organizations And Networking Groups For Support

Here are some professional organizations and networking groups for insurance agents that can offer support and learning opportunities:

- National Association of Professional Insurance Agents (PIA) – Serving independent insurance agents since 1931, PIA offers resources and advocacy for its members.

- International Association of Insurance Professionals (IAIP) – IAIP focuses on developing leaders, influencing careers, and connecting members within the insurance industry.

- Independent Insurance Agents & Brokers of America (IIABA) – Known as the Big “I”, this association represents over a quarter million independent agents and their employees.

- Networking Ideas for Insurance Agents – This resource provides various networking strategies for insurance agents to expand their professional connections.

- Top LinkedIn Groups for Insurance Professionals – A list of popular LinkedIn groups where insurance professionals can network and share insights.

These links can help your readers find valuable communities and resources to enhance their professional growth.

Conclusion: How to Sell Insurance Successfully

Converting leads into loyal clients isn’t just about closing sales—it’s about opening doors to lasting relationships. By understanding the client journey, employing effective sales techniques, and handling objections with finesse, you set the stage for ongoing success. Remember, the key to a thriving life insurance career isn’t just in the policies you sell, but in the trust and loyalty you build along the way.

>> How to Successfully Transition to an Independent Life Insurance Agent