Is it hard to sell life insurance? For many agents, the challenge lies not just in selling a product, but in addressing deeply personal and emotional topics with their clients. Consider this: a young couple, just starting their family, loses the primary breadwinner in a tragic accident. Amidst their grief, they face the overwhelming reality of mounting bills and financial instability. This story, unfortunately, is not uncommon and highlights the critical importance of life insurance. Life insurance agents face the dual challenge of balancing empathy with the need to meet sales targets. Balancing empathy and sales is not only possible but essential for long-term success.

Table of Contents

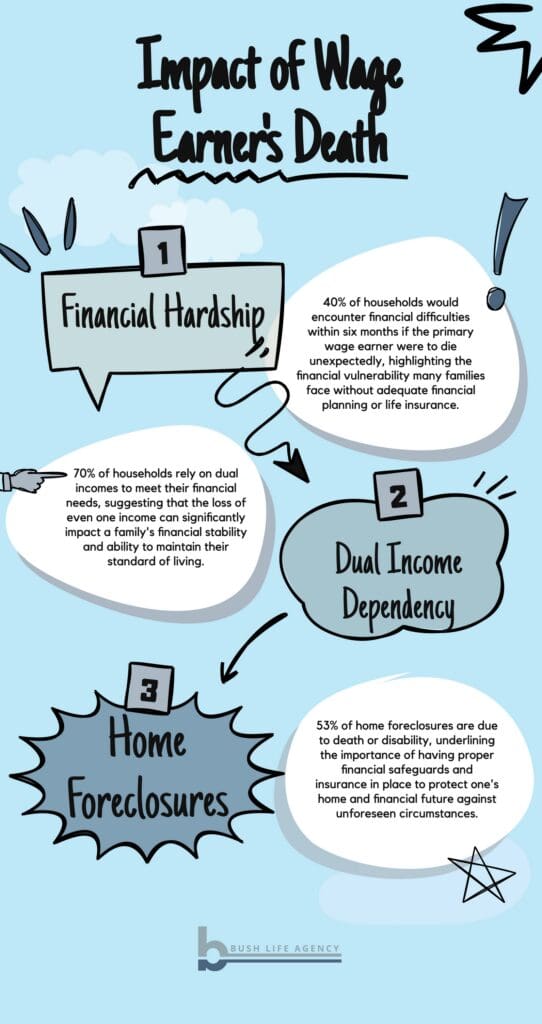

If the primary wage earner were to die unexpectedly, 40% of households would encounter financial difficulties within six months. Furthermore, 70% of households depend on dual incomes, and 53% of home foreclosures result from death or disability.

Understanding the Emotional Landscape

The Sensitivity of the Subject

Talking about life insurance requires clients to confront their own mortality—a topic not typically favored for dinner table discussions, as it involves delving into the subject of their own death.

Life insurance is inherently emotional because it deals with the most sensitive aspects of human life—death and financial insecurity. Clients may react with anxiety, fear, or even denial when discussing these topics. Understanding these emotional triggers is crucial for agents to navigate conversations gently and effectively.

The Importance of Empathy

Empathy in life insurance means more than just understanding; it involves genuinely sharing the feelings of others to build trust and rapport. When clients feel heard and understood, they are more likely to open up and engage in meaningful discussions about their insurance needs.

They are confident in their ability to save enough money to support their family financially. However, the uncertainty of one’s lifespan remains an unknown factor.

Building Empathetic Connections

Active Listening Techniques

Active listening is a cornerstone of empathetic interactions. This involves fully focusing on the client, acknowledging their words with nods or verbal affirmations, and reflecting back what they’ve said to show understanding. Body language, such as maintaining eye contact and an open posture, also plays a crucial role.

The most effective method to truly understand someone is to ask more questions, particularly open-ended ones that provide an opportunity for elaboration.

Personalizing the Conversation

Every client is unique, with distinct concerns and needs. Tailoring your conversation to address these specific issues can make them feel valued and understood. Sharing your own experiences or stories of other clients can humanize the discussion and build relatability.

Validating Emotions

Validating a client’s emotions means acknowledging their feelings without judgment. Simple phrases like “I understand this is difficult to talk about” or “It’s normal to feel this way” can offer comfort and show that you respect their emotional state.

Navigating Difficult Conversations

Addressing Common Objections

Clients often have objections or reservations about purchasing life insurance. Common objections include cost, perceived need, and distrust in the insurance process. Addressing these objections empathetically involves listening to their concerns, validating their feelings, and providing clear, compassionate explanations. Role-playing scenarios can help agents practice handling objections gracefully.

Discussing Sensitive Topics

Talking about mortality and financial instability requires a delicate approach. Start by gently introducing the topic and providing context for why it’s important. Use empathetic language and be prepared to pause the conversation if the client becomes too distressed.

Managing Emotional Reactions

Clients may react emotionally during these conversations, expressing sadness, anger, or frustration. As an agent, it’s essential to remain calm and supportive. Techniques such as deep breathing, maintaining a soft tone, and offering comforting words can help de-escalate tense situations.

Related Article: The Top 10 Myths of Life Insurance Sales

Balancing Empathy with Sales Goals

Setting the Stage for a Balanced Conversation

Before each client interaction, prepare mentally and emotionally. Set compassionate intentions for the meeting, focusing on how you can genuinely help the client while also achieving your sales goals.

Communicating Value

Clearly articulating the value of life insurance is crucial. Frame the conversation around the client’s long-term well-being and how life insurance can provide peace of mind and financial security for their loved ones. This approach helps clients see the inherent value in the product.

Following Up with Care

Follow-up conversations are essential to maintaining a balance between persistence and respect for the client’s pace. Check in with them regularly, offer additional information if needed, and ensure they feel supported throughout the decision-making process.

Conclusion: Is It Hard To Sell Life Insurance?

Balancing empathy and life insurance sales is not just a skill but a necessity for building lasting relationships and trust. By understanding the emotional landscape, building empathetic connections, and navigating difficult conversations with care, agents can achieve their sales goals while genuinely helping clients secure their futures.

Practice these techniques in your daily interactions, and remember: an empathetic approach not only fosters trust but also leads to sustained success in the life insurance industry.