Understanding a life insurance agent salary can be confusing. But knowing what affects them can help. This post explains important things shaping salaries in 2024 and helping industry professionals plan their careers. By learning about these factors, we can better handle challenges and find opportunities in finance. Whether you’re new or experienced, knowing these salary influences will help with salary talks and career choices.

This blog post looks at what will affect life insurance salaries in 2024. By knowing these factors, you can handle the industry better. You’ll be ready to negotiate and plan your career. Let’s see what’s coming and how you can use this information to grow professionally.

Table of Contents

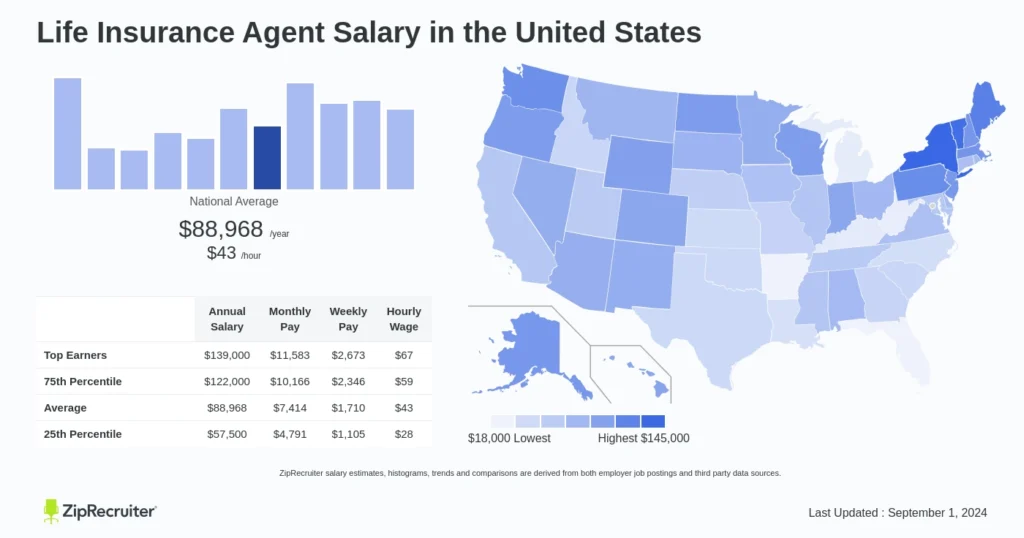

Average Life Insurance Agent Salary

At Bush Life Agency, we get it—family comes first. That’s why we offer a range of insurance products like life, whole life, mortgage protection, annuities, and index universal life to help keep your loved ones safe. Even if you’re new to sales, our first-time agents can earn up to $75-150K a year, and thanks to our proven system and lead generation, you won’t have to worry about cold calling.

We’re looking for folks who are ready to grow, have an entrepreneurial spirit, and embrace a positive attitude. It’s all about being open, motivated, and aligned with our values. If you’re just looking for a salary or aren’t interested in investing in your personal growth, this might not be for you.

You’ll need a laptop with a camera, high-speed internet, a smartphone, and an insurance license (don’t worry, we can help with that if you’re in). We’re all about commission-based success, with cash bonuses and an all-expense-paid trip up for grabs in the first 90 days. We offer top-notch training, chances to advance, and fully remote work if that’s your thing.

Bush Life Agency, teamed up with Quility and Symmetry Financial Group, has been recognized as one of the Inc. 5000 Fastest Growing Companies from 2016-2021. We’ve been named a top place to work by Experience.com and celebrated for our culture by Entrepreneur Magazine.

If you’re ready to start your journey with Bush Life Agency, check out the info videos on our website: https://bushlifeagency.com/becoming-a-life-insurance-agent/

The success, earnings, or production outcomes of any agent should not be considered typical, average, or expected. Results vary among agents, and no specific outcomes are assured. Your success level will depend on several factors, including the effort you invest, your proficiency in applying our training and sales system, your engagement with our lead system, and the insurance needs of customers in your chosen geographic areas.

When you look at the average salary for life insurance agents, you need to consider what type of agent you are analyzing – Independent or Captive agent.

This article will dive into the life insurance agent salary for captive agents.

1. Economic Factors

In today’s ever-changing economic landscape, the insurance industry is really going through some interesting times, with both challenges and opportunities coming our way. Things like inflation, interest rates, and economic growth directly impact life insurance companies—everything from how we price premiums to the way we approach investments. It’s a bit of a balancing act, and I totally get it if it feels overwhelming at times. But remember, navigating these elements carefully is key because they can seriously affect our profitability and sustainability.

As someone working in the industry, it’s crucial to understand how these economic factors play into salary trends. During unstable economic periods, companies might tweak compensation strategies or enhance benefits to keep talent on board. Recognizing these shifts not only helps with personal career planning but also empowers businesses to respond flexibly to market changes.

It’s comforting to realize that despite the economic turbulence, there are ways to adapt and thrive. Staying informed and proactive is like having a roadmap to navigate these complexities with confidence. Let’s keep in mind that it’s perfectly okay to prioritize self-care and balance over constant productivity. So, how do you approach these challenges? What strategies have you found helpful in navigating these times?

How to Successfully Transition to an Independent Life Insurance Agent

Inflation and Cost of Living Adjustments Affecting Salary Structures

I totally get how inflation and the rising cost of living can weigh on our minds, especially when it comes to salaries in the life insurance industry. When inflation goes up, it’s like our paycheck doesn’t stretch as far, right? That’s why companies often look at cost of living adjustments (COLAs) to help keep our financial well-being in check.

It’s natural to feel a bit anxious about keeping things stable financially, especially with so much uncertainty around. But knowing how inflation affects our pay and making a solid case for COLAs can really boost our confidence.

Remember, it’s about finding that sweet spot between what you need and what the economy says. We’re all just trying to maintain our standard of living and ensure our value is recognized. It’s okay to prioritize your well-being and seek that balance. Hang in there, and don’t hesitate to speak up for what you deserve!

2. Industry Trends

The life insurance industry is not immune to the broader trends reshaping the business world. Mergers and acquisitions continue to alter the competitive landscape, influencing salary structures as companies strive to integrate and streamline operations. Additionally, shifts in consumer behavior, such as a growing demand for personalized insurance solutions, are prompting companies to reevaluate their staffing needs and compensation strategies.

Keeping up with industry trends can give professionals useful insights into potential salary changes and help them align their career paths with new opportunities.

3. Technological Advancements

Technology is transforming the life insurance sector, impacting everything from customer service to risk assessment. As companies integrate advanced technologies like artificial intelligence and data analytics, productivity levels and efficiency are expected to rise. This technological shift often translates into changes in salary structures, as companies may offer higher compensation to attract tech-savvy professionals who can navigate these new tools.

4. Regulatory Changes

Regulatory changes continue to be a significant factor influencing life insurance salaries. Compliance with evolving legal requirements can affect operational costs, prompting companies to adjust salary budgets accordingly. In 2024, anticipated regulatory developments may require companies to allocate resources differently, potentially impacting overall compensation strategies.

Professionals in the industry must stay informed about these regulatory shifts, as they can directly influence their earning potential and job security.

5. Geographic Influences

Geographic location remains a critical determinant of salary variations in the life insurance industry. While remote work has blurred some of the traditional boundaries, regional economic health and cost of living differences continue to play a significant role in shaping compensation packages.

For instance, professionals working in urban areas with a higher cost of living may command higher salaries compared to their rural counterparts. Understanding these geographic influences can help professionals make informed decisions about where to work and how to negotiate salaries based on location.

The Future of Life Insurance Jobs: Remote Opportunities For Rewarding Careers

Conclusion: Life Insurance Agent Salary

In conclusion, the factors influencing life insurance salaries in 2024 are multifaceted, encompassing economic conditions, industry trends, technological advancements, regulatory changes, and geographic variations. By understanding these elements, professionals can position themselves strategically within the industry, ensuring they are well-prepared for salary negotiations and career advancement.

Remaining proactive in tracking these trends and adapting to the dynamic landscape of the life insurance sector can empower professionals to make informed career decisions. As we move forward, staying informed and adaptable will be key to navigating the complexities of life insurance salaries in 2024 and beyond.

Are you considering the benefits of becoming an Independent Life Insurance Agent over a captive one, as we discussed here? If so, consider connecting with us to set up a Q/A call to get all your questions answered. Start here.