When a policyholder dies, their life insurance policy pays out a sum of money to their chosen beneficiaries. This payout is known as the life insurance death benefit, and it can be used to help cover final expenses, pay off debts, or be invested for the future. You need to know a few things about the life insurance death benefit, including how it works, the tax implications, and how to choose a beneficiary. Inside this article, discover six things you need to know.

6 Things You Need To Know

1. What is the life insurance death benefit?

The life insurance death benefit is the sum of money a life insurance policy pays out to the policyholder’s beneficiaries upon death. This money can be used for any purpose, including covering final expenses, paying off debts, or investing for the future.

2. How do life insurance death benefits work?

When a policyholder dies, their life insurance policy will pay out a death benefit to their chosen beneficiaries. The beneficiary can use this money for any purpose, including covering final expenses, paying off debts, or investing for the future.

3. What are the tax implications?

The life insurance death benefit is generally tax-free. However, some estate taxes may be owed on the death benefit if the policyholder’s estate is large enough. Consult with a financial advisor or tax professional to determine if any estate taxes will be owed on the life insurance death benefit.

4. Who can be a beneficiary?

Anyone can be a beneficiary of the death benefit, including a spouse, child, parent, or another relative. The policyholder can also name a trust, charity, or business as a beneficiary.

5. What are the payout options?

Two main payout options for the life insurance death benefit are lump sum and installment. With a lump-sum payout, the beneficiary receives the entire death benefit at once. With an installment payout, the beneficiary receives the death benefit in installments over time. The policyholder can choose which payout option they prefer when they purchase their life insurance policy.

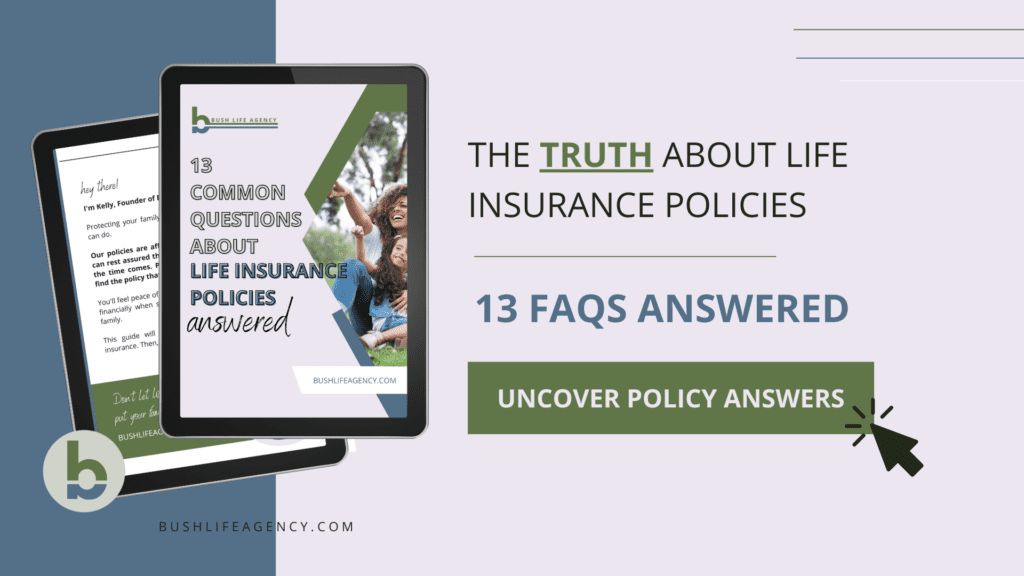

6. What should you consider before buying life insurance?

Consider a few things before buying life insurance, including your needs and budget. You should also compare different life insurance policies to find the one that’s right for you. Be sure to consult with a financial advisor or life insurance agent to get started.

The death benefit can be a helpful way to financially protect your loved ones after you die. Be sure to consider all of the factors involved before purchasing a life insurance policy, and consult with a financial advisor to get started.

Discover more articles about the benefits of life insurance here.

Recap: Understanding Your Life Insurance Policy And Death Benefits

Despite its name, life insurance is not just for people who are alive. A life insurance policy is a contract between you and an insurance company. You pay premiums, and the company agrees to pay a set amount of money—the death benefit—to your beneficiaries upon your death. It can be used for any purpose, from covering final expenses to providing financial security for your loved ones.

It’s important to understand your policy’s features before you purchase it. By doing so, you can be sure that your loved ones will be taken care of financially if something happens to you. Contact us today to find a policy that meets your family’s needs.