Selling life insurance has become more challenging than ever. With a crowded market brimming with diverse options, life insurance agents must navigate the complexities of client needs and preferences while maintaining a competitive edge. The key to thriving in this environment lies in adopting innovative strategies that not only address these challenges but also build trust and foster long-term client relationships. Understanding individual client priorities, differentiating yourself from competitors, and employing a personalized approach are essential components of a successful sales strategy. This article explores four effective strategies that can help life insurance agents enhance their sales techniques and achieve success in a competitive market.

Table of Contents

Mastering Life Insurance Sales: Strategies to Stand Out in a Competitive Market

In today’s rapidly evolving financial landscape, selling life insurance has become more challenging than ever. The market is crowded with numerous providers, all vying for consumer attention. At the same time, consumer expectations are shifting, with buyers seeking more personalized, transparent, and flexible insurance solutions.

A study by the LIMRA and Life Happens shows that in 2023, the percentage of people who reported having life insurance increased to 52%, up from 50% in the previous year. (market watch)

This statistic leaves 48% of the population in the U.S. still up for grabs when it comes to choosing the right agency to work with.

For agents, this means navigating a complex market where trust can be hard to earn, and differentiation is key.

To succeed, insurance agents must employ innovative strategies that not only attract but also retain clients. Let’s explore some effective strategies for selling life insurance in this competitive environment.

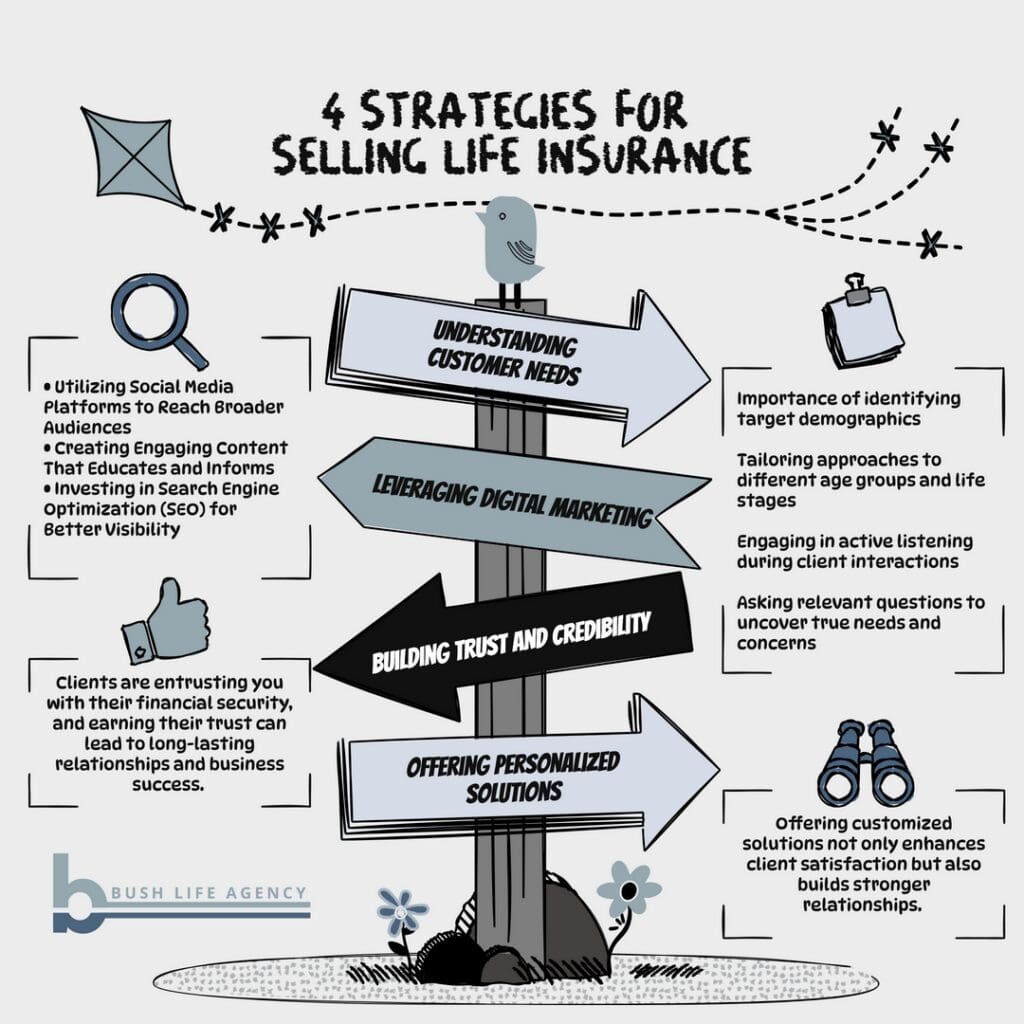

1. Understanding Customer Needs

Understanding what your clients need is the cornerstone of effective sales. Start by identifying the target demographics you wish to serve. Different age groups, family situations, and life stages require different approaches.

For instance, young families might prioritize policies that offer affordable protection for dependents, whereas older adults might look for products that focus on estate planning or long-term care.

Active Listening as a Crucial Skill for Insurance Agents

Active listening is a fundamental skill that can significantly impact the success of an insurance agent. By fully concentrating, understanding, responding, and remembering what clients say, agents can more effectively address their clients’ concerns and needs.

This skill involves not just hearing the words but also interpreting the emotions and intentions behind them. When clients feel genuinely heard, their trust in the agent increases, fostering a stronger relationship.

Additionally, active listening enables agents to gather critical information that can be used to tailor insurance policies to fit the unique circumstances of each client.

By honing this skill, insurance agents can differentiate themselves from the competition, demonstrate empathy, and ultimately drive higher satisfaction and loyalty among their clientele.

Asking Open-ended Questions to Encourage Clients to Share Their Concerns and Needs

Asking open-ended questions is another crucial technique for insurance agents to uncover clients’ true concerns and needs. Unlike close-ended questions which can often be answered with a simple “yes” or “no,” open-ended questions invite clients to elaborate, providing more detailed and insightful responses.

For example, instead of asking, “Are you looking for life insurance?” an agent could ask, “What are the primary factors driving your interest in life insurance at this time?”

Ideas: 10 Open-Ended Questions To Ask Clients

- How do you envision your financial goals evolving over the next few years, and how might life insurance play a role in achieving them?

- Can you share more about your current family situation and any specific concerns you have about providing for their future needs?

- What are the most important factors for you when considering life insurance coverage, and how do you think these needs might change as you age?

- How does your current life insurance coverage align with your long-term objectives, and are there any gaps you’re concerned about?

- In thinking about your family’s financial security, what are some of the fears or uncertainties you would like to address with life insurance?

- How do you prioritize different financial goals, such as retirement savings or education funds for your children, when considering life insurance options?

- What experiences or stories have influenced your views on the importance of life insurance for your family?

- How would you describe your ideal scenario for your family’s financial stability if something unexpected were to happen to you?

- Can you detail any specific financial obligations or future expenses you anticipate that life insurance could help cover?

- What steps have you already taken to prepare for your family’s financial future, and how can life insurance complement those efforts?

This approach not only yields richer information but also signals to clients that their opinions and experiences are valued.

By creating a more interactive and engaging dialogue, insurance agents can better understand each client’s unique situation and offer more personalized and relevant solutions.

Furthermore, open-ended questions help in building a rapport and trust, as clients feel listened to and understood, setting a strong foundation for a lasting professional relationship.

Recap of Understanding Customer’s Needs:

- Importance of identifying target demographics

- Tailoring approaches to different age groups and life stages

- Engaging in active listening during client interactions

- Asking relevant questions to uncover true needs and concerns

2. Leveraging Digital Marketing

Digital marketing is an essential tool for reaching today’s tech-savvy consumers.

Utilizing Social Media Platforms to Reach Broader Audiences

- Building a strong social media presence: Establishing active profiles on platforms like Facebook, LinkedIn, X, and Instagram to engage with potential clients.

- Content creation and sharing: Regularly sharing valuable content such as articles, infographics, and videos related to life insurance, financial planning, and personal stories that resonate with different demographics.

- Targeted advertising: Using social media ads to focus on specific demographics, allowing for personalized marketing strategies based on age, interests, and geographic location.

- Engaging with followers: Responding to comments, messages, and inquiries promptly to build trust and demonstrate commitment to customer service.

- Hosting live sessions and webinars: Offering live Q&A sessions or webinars on topics like the importance of life insurance, which can help educate and attract potential buyers.

- Utilizing analytics tools: Monitoring engagement metrics and audience demographics to refine social media strategies and improve ROI.

Creating Engaging Content That Educates and Informs

- Developing informative blog posts: Crafting detailed blog posts that cover various aspects of life insurance, such as benefits, different policy types, and common misconceptions. This helps in establishing authority and providing valuable information to potential clients.

- Creating educational videos: Producing short, informative videos that explain life insurance concepts in simple terms. Visual content can be more engaging and easier to understand, making it a powerful tool for educating clients.

- Offering downloadable resources: Providing e-books, guides, and checklists that clients can download for free. These resources should cover essential topics like choosing the right life insurance policy, understanding premiums, and the claims process.

- Writing case studies and testimonials: Showcasing real-life examples of how life insurance has benefited clients. This builds credibility and helps potential buyers relate to the situations of others.

- Conducting webinars and online workshops: Hosting sessions where experts discuss various topics related to life insurance, allowing participants to ask questions and interact. This approach can help foster a sense of community and trust.

- Creating interactive tools and calculators: Offering online tools that allow clients to calculate premiums, compare different policies, or estimate coverage needs. Interactive content can enhance user experience and engagement.

- Publishing newsletters: Sending out regular email newsletters with updates, tips, and articles related to life insurance. Consistent communication helps in maintaining engagement and keeping your audience informed.

Investing in Search Engine Optimization (SEO) for Better Visibility

Search engine optimization (SEO) is a crucial strategy for improving your digital footprint and attracting potential clients in a competitive life insurance market. Here are some essential tactics to invest in SEO effectively:

- Keyword research: Identifying and utilizing high-traffic keywords related to life insurance can help your content rank higher on search engines. Consider long-tail keywords that are more specific and often less competitive.

- Optimizing website content: Ensuring your website is rich with relevant keywords, includes meta descriptions, and has properly structured headings (H1, H2) can improve search engine rankings. Regularly updating your blog with fresh, keyword-rich content can also enhance visibility.

- Improving website performance: Search engines favor websites that load quickly and are mobile-friendly. Investing in technical improvements, such as optimizing page speed and ensuring mobile compatibility, can significantly boost your SEO efforts.

- Building backlinks: Acquiring quality backlinks from reputable sites in the financial sector can enhance your site’s authority and ranking. Consider guest blogging, content partnerships, and contributing articles to industry publications.

- Utilizing local SEO: For life insurance agents with a specific geographic focus, listing your business on local directories and Google My Business can improve your visibility in local search results. Incorporate local keywords and gather customer reviews to strengthen your local presence.

- Creating high-quality content: Consistently publishing informative, well-researched content relevant to your target audience encourages longer site visits and more shares, which positively impacts SEO. Aim to answer common questions and provide value through your content.

- Monitoring and analytics: Use tools like Google Analytics and SEMrush to track your SEO performance. Monitoring metrics such as organic traffic, bounce rate, and conversions will help you understand what’s working and where improvements are needed.

By investing in these SEO strategies, you can significantly enhance your website’s visibility, attract more potential clients, and maintain a competitive edge in the life insurance market.

3. Building Trust and Credibility

In the competitive landscape of life insurance sales, building trust and credibility is paramount. Clients are entrusting you with their financial security, and earning their trust can lead to long-lasting relationships and business success. Here’s how you can effectively build trust and establish credibility:

Establishing a Strong Personal Brand as a Trustworthy Advisor

Your personal brand is the perception clients have of you as a professional. To position yourself as a trustworthy advisor, it’s essential to showcase integrity, reliability, and expertise. Start by maintaining a consistent and professional online presence.

Use platforms like LinkedIn to share insights and engage with your audience. Ensure your messaging is clear, honest, and consistent across all channels. By doing so, you enhance your reputation as someone who is knowledgeable and dependable.

Sharing Testimonials and Success Stories

Potential clients are more likely to trust you if they see that others have had positive experiences. Collect and share testimonials from satisfied clients who can vouch for your expertise and assistance. Highlight success stories where your advice led to positive outcomes for clients, such as helping a family secure affordable coverage that met their needs.

These testimonials can be featured on your website, social media, and in marketing materials to build credibility.

Offering Transparency in Policy Details and Pricing

Transparency is crucial in fostering trust. Clients need to feel confident that they understand what they are purchasing. Be upfront about policy details, including benefits, limitations, and costs.

Avoid jargon and explain terms in a way that is easy to understand. Provide clear comparisons of different policy options to help clients make informed decisions.

This approach reassures clients that there are no hidden surprises and builds their confidence in your integrity.

Educating Clients on Policy Benefits and Limitations

Educating clients is an investment in building trust. Take the time to explain the benefits and limitations of different policies thoroughly. Offer educational resources, such as brochures or online guides, that clients can refer to at their convenience.

By ensuring clients fully understand what they are purchasing, you demonstrate that you have their best interests at heart, which strengthens trust.

Demonstrating Expertise through Thought Leadership

Positioning yourself as a thought leader in the life insurance industry can significantly boost your credibility. Thought leadership involves sharing valuable insights and knowledge with a broader audience.

Write articles for industry publications or your own blog that address common client concerns or emerging trends in the insurance market.

Host webinars and offer to speak at industry events to share your expertise. These activities not only enhance your visibility but also establish you as a knowledgeable expert in the field.

Practical Tips:

- Consistently Engage with Your Audience: Regularly post content that is useful and relevant to your target audience to keep them engaged and informed.

- Encourage Client Reviews: Ask satisfied clients to leave reviews on platforms like Google or Yelp, where potential clients are likely to search for feedback.

- Create Educational Content: Develop videos, infographics, and articles that explain complex insurance concepts in simple terms.

- Networking and Collaboration: Collaborate with other professionals in finance or related fields to co-host events or webinars, which can expand your reach and enhance your credibility.

By focusing on these strategies, you can build a foundation of trust and credibility that not only attracts new clients but also fosters loyalty with existing ones.

4. Offering Personalized Solutions

In the world of life insurance sales, personalization is key to meeting the unique needs of each client. Offering customized solutions not only enhances client satisfaction but also builds stronger relationships. Here’s how you can effectively offer personalized life insurance solutions:

Customizing Life Insurance Plans to Fit Individual Client Needs

Every client has different financial goals, family situations, and risk tolerances. Tailoring life insurance plans to accommodate these differences is crucial.

- Start by understanding the client’s specific situation—are they looking for protection, investment, or both?

- Customize the plan to align with their life stage, whether they are young professionals, parents, or nearing retirement.

By crafting a plan that fits their unique needs, clients will feel valued and understood.

Conducting Thorough Assessments to Recommend Suitable Products

A comprehensive assessment is the foundation of offering personalized solutions. Conduct in-depth consultations to gather information about the client’s financial status, future goals, and any existing coverage.

Use this data to recommend products that best suit their needs.

For example, a young family might benefit from a term life policy with the option to convert to permanent insurance later.

By aligning recommendations with their specific circumstances, you demonstrate a genuine commitment to their financial wellbeing.

Providing Flexible Options and Riders to Enhance Policy Value

Flexibility is a significant advantage in life insurance products. Offer riders and additional options that allow clients to customize their coverage further.

Riders such as accidental death, waiver of premium, or accelerated death benefits can add significant value to a policy.

Explain how these options can provide extra layers of security or adapt to changing life circumstances.

By offering these enhancements, clients have the flexibility to tailor their coverage as their needs evolve.

Discussing Additional Coverage Options for Comprehensive Protection

In many cases, clients may not be aware of the different types of coverage available. Educate them on options like critical illness coverage, disability insurance, or long-term care insurance, which can complement life insurance policies.

Discussing these options helps clients consider a more holistic approach to their insurance needs, ensuring they are comprehensively protected against various life risks.

Regularly Reviewing and Updating Policies with Clients

Client needs change over time, and it’s essential to ensure their insurance coverage keeps pace. Schedule regular policy reviews to reassess their needs and make necessary adjustments. Major life events such as marriage, the birth of a child, or a career change can significantly impact insurance needs.

Regular reviews provide an opportunity to enhance or adjust coverage, ensuring clients remain adequately protected.

Practical Tips:

- Use Technology to Personalize: Utilize CRM systems to track client information and preferences, allowing for more personalized communication and service.

- Create a Checklist for Assessments: Develop a standardized assessment checklist to ensure you collect all necessary information during client consultations.

- Educate with Examples: Use real-life scenarios and examples to help clients understand the benefits of various coverage options and riders.

- Establish a Review Schedule: Implement a system to remind both you and your clients of policy review dates to ensure ongoing engagement and service.

By focusing on personalization, you can provide clients with tailored solutions that meet their unique needs, ultimately leading to higher satisfaction and loyalty.

Conclusion: Selling Life Insurance

In a competitive market, selling life insurance requires a strategic approach that adapts to changing dynamics. By understanding customer needs, leveraging digital marketing, building trust, and offering personalized solutions insurance agents can differentiate themselves and enhance their sales performance.

Now is the time to take action.

Start implementing these strategies to enhance your sales performance and build lasting client relationships. At Bush Life Agency, we are committed to supporting our agents in achieving their goals. If you are passionate about helping clients secure their financial futures and eager to work in a dynamic environment, consider joining our team.

How to start selling life insurance?

Reach out to us at Bush Life Agency today to start the conversation and explore opportunities and see how you can make a difference as part of our team.

BOOK A 15-MINUTE INTERVIEW CALL HERE!